Business Insurance in and around Lubbock

One of the top small business insurance companies in Lubbock, and beyond.

Insure your business, intentionally

This Coverage Is Worth It.

It takes courage to start your own business, and it also takes courage to admit when you might need guidance. State Farm is here to help with your business insurance needs. With options like a surety or fidelity bond, extra liability coverage and worker's compensation for your employees, you can rest assured that your small business is properly protected.

One of the top small business insurance companies in Lubbock, and beyond.

Insure your business, intentionally

Strictly Business With State Farm

At State Farm, apply for the great coverage you may need for your business, whether it's a drug store, an arts and crafts store or a toy store. Agent Chris Prather is also a business owner and understands your needs. Not only that, but customizing policy options is another asset that sets State Farm apart. From one small business owner to another, see if this coverage can't be beat.

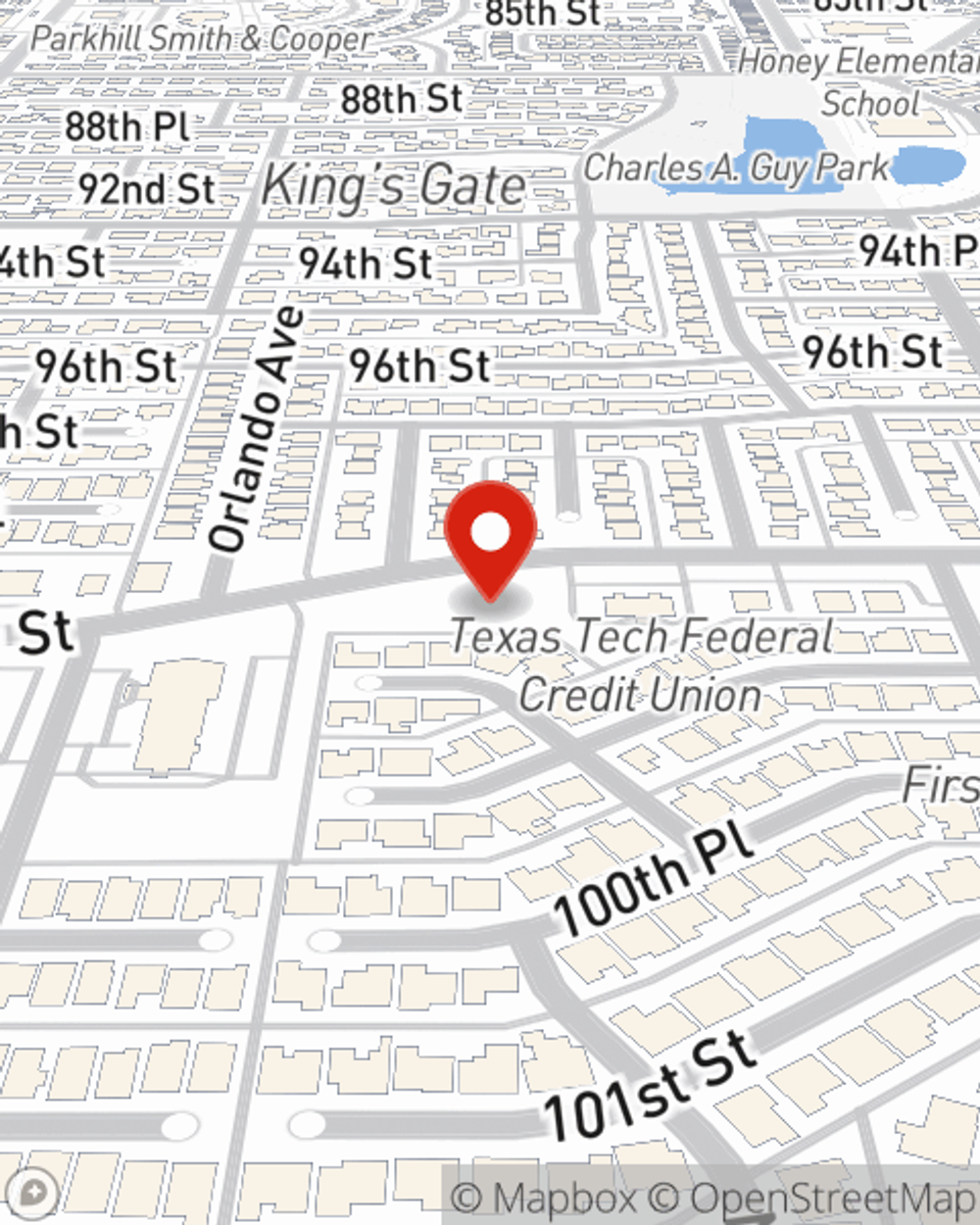

Get right down to business by calling or emailing agent Chris Prather's team to discuss your options.

Simple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

Chris Prather

State Farm® Insurance AgentSimple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.